Investors should remember that the value of an investment and the income received from it can go down as well as up, and that they may not get back the amount they invested. Sage advice for any investor.

You may think it odd then that commercial office leases in the UK still provide for the annual rent agreed at lease commencement to be subject to rent review on an ‘upward only’ basis.

Rent reviews became common in commercial property leases during the 1960s and 1970s as a mechanism for adjusting existing lease rents to current market levels. They were devised specifically to protect the value of landlords’ interests in an inflationary environment whilst enabling tenants to secure traditionally favoured long-term leases.

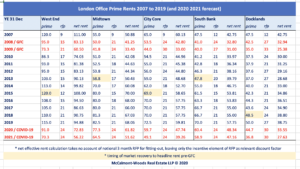

In the UK rent reviews typically occur once every five years and it is now unusual to come across office leases that provide for a longer review pattern. Upward only means that the rent paid by the tenant cannot reduce at review time, even if the open market rent at the relevant review date is deemed to be lower than the rent passing.

Whilst it is too early to forecast how the market will fare post the immediate crisis, all of the tenant representatives and brokers we have spoken with intuitively feel that rents will come under downward pressure. Only time will tell!

The British Property Federation (BPF), the trade association for UK landlords, noted that the traditional upward-only rent review remains dominant in the UK commercial property market and, indeed, is seen by some as a major contributor to the attractiveness of the UK market to commercial real estate investors. Consequently, there is little appetite to change the ‘status-quo’, but occupiers are likely to think differently if exposed in a falling market to over-rented premises which prove both expensive and difficult to dispose of.

Intended to improve transparency and fairness in the negotiation of commercial leases, the new RICS ‘Code for leasing business premises’ (1st edition, February 2020) was an opportunity missed to pivot away from the constraints of upward only rent reviews.

With businesses haemorrhaging cash and searching for ways to stem the bleeding, occupiers across the retail, leisure and F&B sectors are actively seeking relief through rental waivers and deferred payments. Certain flexible space market (FSM) providers are closing down centres and seeking CVA arrangements to protect and survive. And, as various well-known retail brands enter administration, the case for business rates relief to enable the high street to compete with online retail grows ever stronger.

The shortening of leases over the past two decades has represented a major structural shift in the commercial property market. Rarely these days will occupiers sign-up for 25-year leases unless they are entering into very large lettings (and pre-lettings) or acquiring premises requiring a high level of fitting-out capex.

The average office lease length in the UK today is now closer to 5-years, having come in from the average lease length of 6.8 years in 2014. The impact of IFRS 16 requiring tenants to bring all operating leases on balance sheet (by recognising a ‘right-of-use’ asset and corresponding lease liability) may have also influenced some occupiers’ decisions to enter into shorter lease terms post January 2019.

As businesses review their space and headcount requirements, the risk for owners and investors is that faced with an upward only rent review and a significant deficit between the rent paid and market value, tenants will vote with their feet, exercising lease breaks which may be coincidental with the rent review. In extremis, they could even default, leaving landlords with unwanted vacancies and possibly also significant rent arrears. Consequently, on new lease acquisitions it is to be expected that occupiers will gravitate towards those properties which offer more flexible lease terms, including enterprise spaces within the FSM sector, given the likely trade-off between pricing and lease flexibility.

With landlords facing billions of pounds in lost or deferred rents and expected to take another hit at the June rent quarter-day, there clearly needs to be a recognition of the problems faced by both owners and occupiers. It will be interesting to see whether the Covid-19 pandemic acts as a catalyst for change.

Since there has been little debate on the merits of incorporating upward and downward rent reviews in new lease agreements (maybe there are too many players with vested interests?) we asked our friends, Paul McDowell and Stuart Allison, to explain how rent reviews in Ireland and Australia work. Here’s what they had to say…

Paul R McDowell, Principal, Paul McDowell Ltd, Dublin:

“Up until January 2010, Ireland followed the UK practice of upward only reviews. However, these were banned by law following tenant lobbying pressure as a consequence of the 2008/9 economic crash. In reality, it has had little effect as rents in all sectors continued to increase following the historic lows of 2010. Some landlords now favour indexed rents at review with caps & collars. Obviously, future rent reviews will be more impacted as rents are destined to fall due to the current pandemic.

In terms of investment, it did create a marginal two-tier market between assets with pre or post January 2010 leases, but a move towards a pattern of shorter lease terms and 5-year breaks largely negated this difference. One now needs to make a more critical assessment of rental values when arriving at capital value decisions. However, such market reviews have had zero negative impact upon the large swathes of overseas investment flooding into the Irish market since 2010.”

Stuart Allison, CEO & Principal, ResolveXO, Melbourne & Sydney:

“Market rent reviews are becoming a less common feature in Australian commercial property leases with most landlords and tenants preferring to agree to annual increases across the term of the lease for certainty, typically 3% to 4% pa.

Rent reviews usually only occur in leases at the commencement of an option to extend the lease period but even then, both parties typically prefer to work out the terms of any renewal package in advance, with landlords preferring higher face rents, and tenants preferring to negotiate and receive more generous incentives.

This is a change on 20 years ago where upwards only (known as ratchet clauses locally) face rent reviews were commonplace. While rental growth has been consistent since, incentive packages have been on a roller coaster and this has driven both parties to work towards a process that allows for a closer outcome to market. We are even seeing clauses now that require the determining valuer to provide a determination on the rent and market incentive!”

We are keen to hear your views on any issues affecting corporate occupiers, and how businesses might adapt and evolve in the new normal. Please e-mail us with your thoughts.